Gig Economy Reports

About the Reports

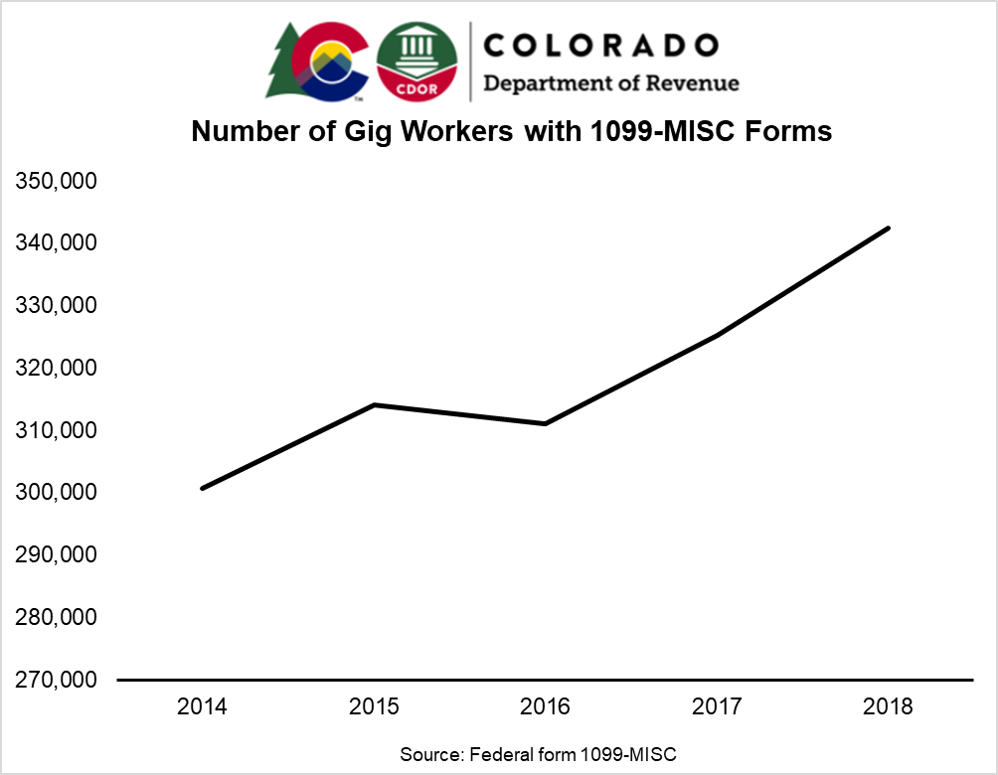

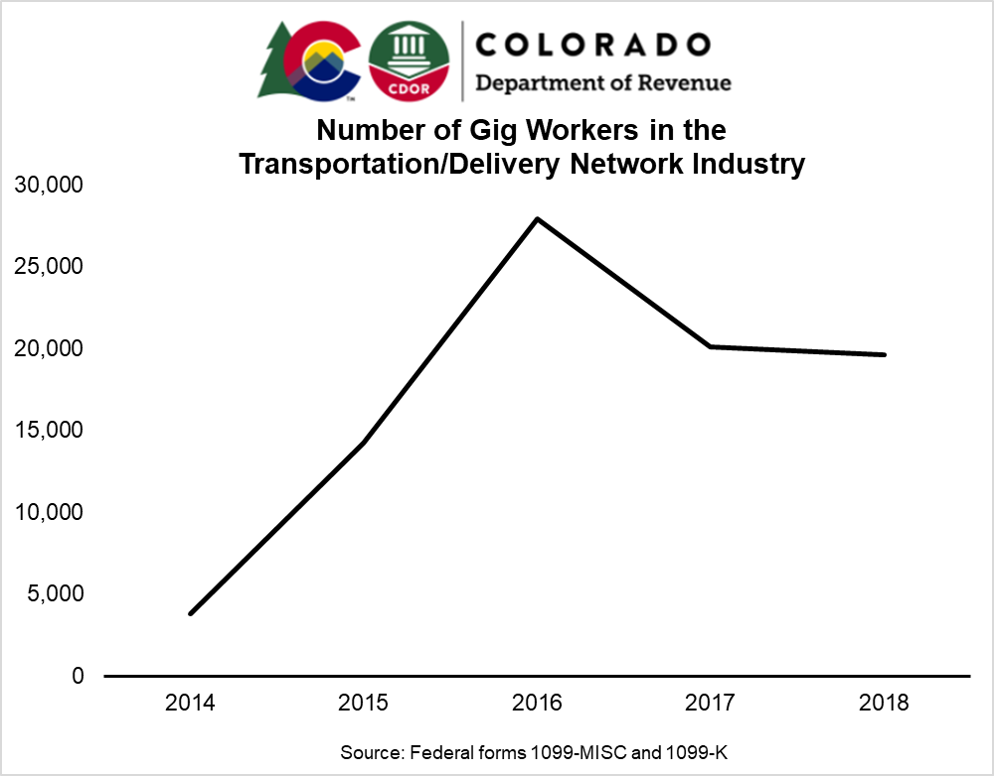

The “gig economy” refers to the labor market where people earn income from short-term contracts or freelance work, often through a digital platform such as an app or website. The name comes from workers earning money for each task, or “gig”, they complete, rather than being paid a wage or salary based on the amount of time they worked. The businesses that gig workers are paid by may send the following forms to the IRS: Form 1099-K or Form 1099-MISC. The Gig Economy Reports summarize aggregate information from these IRS forms to help analyze the gig economy in Colorado.

Data on Forms 1099-K and 1099-MISC is typically available two years after the end of the taxing year. For example, we can begin processing tax year 2019 data in January 2022. The reports will be updated annually as new tax years become available.

Upcoming Reports

There will be additional reports added to this website that show breakouts of gig economy data by income, location, and industry classification.

Have a question or a data request related to this page?