Individual Statistics of Income Reports

About the Reports

The Colorado Individual Statistics of Income (SOI) report is a collection of data sourced from federal and state individual income tax returns filed by full-year Colorado residents. The reports include data on income, taxes, age, location, and more. Colorado’s Individual SOI report complements the Individual SOI report published by the Internal Revenue Service (IRS), and serves as a useful tool for researchers and policy makers.

Beginning with tax year 2021, state and federal return statistics are reported separately. State data is available earlier (two years after each tax year ends), while federal data follows later (three to four years after each tax year ends). Reports prior to 2021 used single combined datasets that merged federal and state return data, thereby delaying the release of state data due to its dependence on federal data.

For tax years 2021 and later, state income tax credit data are available on the Income Tax Credits webpage and state income tax subtraction data are available on the Income Tax Subtractions webpage.

Reports

- 2023 State Return Data

State Return Data Tables:

2023 State Return Data Folder - Use this link to access all tables via Google Drive

- Table 1. Income and Tax Data by Size of Federal Adjusted Gross Income

- Table 2. Income and Tax Data by Size of Federal Adjusted Gross Income in $10,000 Increments

- Table 3. Income and Tax Data by Size of Federal Adjusted Gross Income and Single or Joint Filers

- Table 4. Income and Tax Data by Size of Federal Adjusted Gross Income and Age Group

- Table 5. Income and Tax Data by County

- Table 6. Selected Colorado Additions by Size of Federal Adjusted Gross Income

- Table 7. Income Tax Prepayments by Size of Federal Adjusted Gross Income

- Table 8. Income and Tax Data by Size of Colorado Taxable Income in $10,000 Increments

Methodology:

The State Return Data Tables summarizes data from state income tax returns filed by full-year Colorado residents for income tax year 2023. Income tax year is defined by the year that a taxing period began. Most individuals file using a calendar year, but a small number of filers use a fiscal year. Returns filed by part-year residents and nonresidents are not included in this report.

Data for 2023 Colorado income tax returns were extracted on August 21, 2025, reflecting a snapshot of the returns at that time. The data often reflects initial submissions and may not include subsequent corrections or amended returns. All tax return data is subject to change.

To ensure taxpayer confidentiality, disclosure analysis was performed on each variable for each table. The Department only releases aggregated state data if no single taxpayer represents over 80% of the total and if there are at least three taxpayers per group. Suppressed values due to confidentiality are marked "NR" in the data tables.

Supplemental Information:

- Data Sources

- Supplemental Table: Colorado Income and Tax Data by Size of Colorado Taxable Income in $10,000 Increments for All Taxpayers

- Includes all returns in the State Return Data Tables plus all part-year resident and nonresident returns.

- 2022 State Return Data

State Return Data Tables:

2022 State Return Data Folder - Use this link to access all tables via Google Drive

- Table 1. Income and Tax Data by Size of Federal Adjusted Gross Income

- Table 2. Income and Tax Data by Size of Federal Adjusted Gross Income in $10,000 Increments

- Table 3. Income and Tax Data by Size of Federal Adjusted Gross Income and Single or Joint Filers

- Table 4. Income and Tax Data by Size of Federal Adjusted Gross Income and Age Group

- Table 5. Income and Tax Data by County

- Table 6. Selected Colorado Additions by Size of Federal Adjusted Gross Income

- Table 7. Income Tax Prepayments by Size of Federal Adjusted Gross Income

- Table 8. Income and Tax Data by Size of Colorado Taxable Income in $10,000 Increments

Methodology:

The State Return Data Tables summarize income and tax data from a dataset of state returns filed by full-year Colorado residents for tax year 2022. Returns filed by part-year residents and nonresidents are not included in this report.

Income tax year is defined by the year that a taxing period began. Most individuals file using a calendar year, but a small number of filers use a fiscal year.

Data for 2022 Colorado income tax returns were extracted on August 22, 2024, reflecting a snapshot of the returns at that time. The data often reflects initial submissions and may not include subsequent corrections or amended returns. All tax return data is subject to change.

To ensure taxpayer confidentiality, disclosure analysis was performed on each variable for each table. The Department only releases aggregated state data if no single taxpayer represents over 80% of the total and if there are at least three taxpayers per group. Suppressed values due to confidentiality are marked "NR" in the data tables.

Supplemental Information:

- Data Sources

- Supplemental Table: Colorado Income and Tax Data by Size of Colorado Taxable Income in $10,000 Increments for All Taxpayers

- Includes all returns in the State Return Data Tables plus all part-year resident and nonresident returns.

- 2021 State Return Data

State Return Data Tables:

2021 State Return Data Folder - Use this link to access all tables via Google Drive

- Table 1. Income and Tax Data by Size of Federal Adjusted Gross Income

- Table 2. Income and Tax Data by Size of Federal Adjusted Gross Income in $10,000 Increments

- Table 3. Income and Tax Data by Size of Federal Adjusted Gross Income and Single or Joint Filers

- Table 4. Income and Tax Data by Size of Federal Adjusted Gross Income and Age Group

- Table 5. Income and Tax Data by County

- Table 6. Additions to Income by Size of Federal Adjusted Gross Income

- Table 7. Income Tax Prepayments by Size of Federal Adjusted Gross Income

- Table 8. Income and Tax Data by Size of Colorado Taxable Income in $10,000 Increments

Methodology:

The State Return Data Tables summarize income and tax data from a dataset of state returns filed by full-year Colorado residents for tax year 2021. Returns filed by part-year residents and nonresidents are not included in this report.

Income tax year is defined by the year that a taxing period began. Most individuals file using a calendar year, but a small number of filers use a fiscal year.

Data for 2021 Colorado income tax returns were extracted on August 24, 2023, reflecting a snapshot of the returns at that time. The data often reflects initial submissions and may not include subsequent corrections or amended returns. All tax return data is subject to change.

To ensure taxpayer confidentiality, disclosure analysis was performed on each variable for each table. The Department only releases aggregated state data if no single taxpayer represents over 80% of the total and if there are at least three taxpayers per group. Suppressed values due to confidentiality are marked "NR" in the data tables.

Supplemental Information:

- Data Sources

- Supplemental Table: Colorado Income and Tax Data by Size of Colorado Taxable Income in $10,000 Increments for All Taxpayers

- Includes all returns in the State Return Data Tables plus all part-year resident and nonresident returns.

- 2021 Federal Return Data

Federal Return Data Tables:

2021 Federal Return Data Folder - Use this link to access all tables via Google Drive

- Table 1. Income and Tax Data by Size of Federal Adjusted Gross Income

- Table 2. Income and Tax Data by Size of Federal Adjusted Gross Income in $10,000 Increments

- Table 3. Income and Tax Data by Size of Federal Adjusted Gross Income and Federal Filing Status

- Table 4. Source of Income by Size of Federal Adjusted Gross Income

- Table 5. Business Income by Industry

- Table 6. Adjustments to Income by Size of Federal Adjusted Gross Income

- Table 7. Standard, Itemized, and Qualified Business Income Deductions by Size of Federal Adjusted Gross Income

- Table 8. Itemized Deductions by Size of Federal Adjusted Gross Income

- Table 9. Selected Federal Tax Credits by Size of Federal Adjusted Gross Income

- Table 10. Income and Tax Data by Size of Colorado Taxable Income in $10,000 Increments

Methodology:

The Federal Return Data Tables summarize income and tax data from a merged dataset of state and federal tax returns filed by full-year Colorado residents for tax year 2021. Returns filed by part-year residents and nonresidents are not included in this report. Colorado returns are excluded if their federal income information does not align with their federal return. The Federal Return Data is a subset of the State Return Data.

Income tax year is defined by the year that a taxing period began. Most individuals file using a calendar year, but a small number of filers use a fiscal year.

Data for 2021 federal and Colorado income tax returns were extracted on August 24, 2023, reflecting a snapshot of the returns at that time. The data often reflects initial submissions and may not include subsequent corrections or amended returns. All tax return data is subject to change.

To ensure taxpayer confidentiality, disclosure analysis was performed on each variable for each table. Federal guidelines require a minimum of 10 taxpayers per group for state-level information release. Additionally, the Department only releases aggregated data if no single taxpayer represents over 80% of the total. Suppressed values due to confidentiality are marked "NR" in the data tables.

Supplemental Information:

- 2020

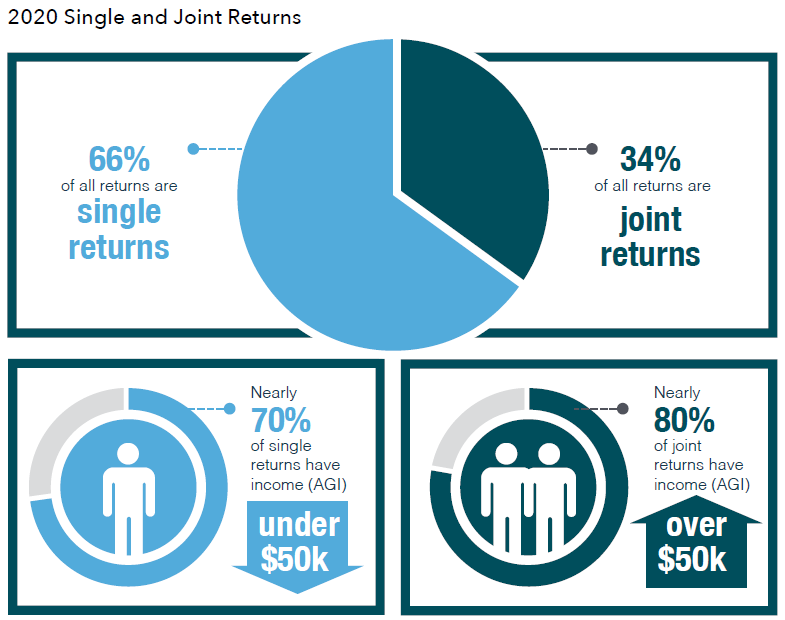

2020 Infographic Details:

- 66% of all 2020 returns are single returns; 34% are joint

- Nearly 70% of single returns have income (AGI) under $50K; Nearly 80% of joint returns have income over $50K

Full Report:

- 2020 Individual SOI Report (PDF) includes an introduction, charts, and selected tables

- 2020 Folder use this link to access the report and all tables

Data Tables:

- Table 1. Income and Tax Data by Size of Federal AGI

- Table 2. Income and Tax Data by Size of Federal AGI in $10,000 Increments

- Table 3. Income and Tax Data for Single Colorado Returns by Size of Federal AGI

- Table 4. Income and Tax Data for Joint Colorado Returns by Size of Federal AGI

- Table 5. Income and Tax Data for Taxable Returns by Size of Federal AGI

- Table 6. Income and Tax Data for Nontaxable Returns by Size of Federal AGI

- Table 7. Income and Tax Data for Filers Under 65 by Size of Federal AGI

- Table 8. Income and Tax Data for Filers 65 and Older by Size of Federal AGI

- Table 9. Federal AGI by Size of Federal AGI and Filing Status

- Table 10. Colorado Net Tax by Size of Federal AGI and Filing Status

- Table 11. Federal AGI by Size of Federal AGI and Age Group

- Table 12. Colorado Net Tax by Size of Federal AGI and Age Group

- Table 13. Source of Income by Size of Federal AGI

- Table 14. Business Income by Industry

- Table 15. Adjustments to Income by Size of Federal AGI

- Table 16. Income and Tax Data by Size of Federal AGI and Standard/Itemized Deduction Returns

- Table 17. Standard, Itemized, and Qualified Business Income Deductions by Size of Federal AGI

- Table 18. Itemized Deductions by Size of Federal AGI

- Table 19. Selected Federal Tax Credits by Size of Federal AGI

- Table 20. Income and Tax Data by Region

- Tables 21A-E: Income and Tax Data for Regions by Size of Federal AGI:

- Table 21A. Income and Tax Data for Central Mountains Region by Size of Federal AGI

- Table 21B. Income and Tax Data for Eastern Plains Region by Size of Federal AGI

- Table 21C. Income and Tax Data for Front Range Region by Size of Federal AGI

- Table 21D. Income and Tax Data for San Luis Valley Region by Size of Federal AGI

- Table 21E. Income and Tax Data for Western Slope Region by Size of Federal AGI

- Table 22. Income and Tax Data by County

- Tables 23A-K: Income and Tax Data for Major Counties by Size of Federal AGI:

- Table 23A. Income and Tax Data for Adams County by Size of Federal AGI

- Table 23B. Income and Tax Data for Arapahoe County by Size of Federal AGI

- Table 23C. Income and Tax Data for Boulder County by Size of Federal AGI

- Table 23D. Income and Tax Data for Denver County by Size of Federal AGI

- Table 23E. Income and Tax Data for Douglas County by Size of Federal AGI

- Table 23F. Income and Tax Data for El Paso County by Size of Federal AGI

- Table 23G. Income and Tax Data for Jefferson County by Size of Federal AGI

- Table 23H. Income and Tax Data for Larimer County by Size of Federal AGI

- Table 23I. Income and Tax Data for Mesa County by Size of Federal AGI

- Table 23J. Income and Tax Data for Pueblo County by Size of Federal AGI

- Table 23K. Income and Tax Data for Weld County by Size of Federal AGI

- Table 24. Colorado Income and Tax Data by Size of Colorado Taxable Income in $10,000 Increments

- Table 25. Colorado Additions and Subtractions by Size of Federal AGI

- Table 26. Colorado Income Tax Prepayments by Size of Federal AGI

- Table 27. Colorado Tax Credits by Size of Federal AGI

Supplemental Information:

- Data Sources

- Methodology

- Supplemental Table: Colorado Income and Tax Data by Size of Colorado Taxable Income in $10,000 Increments for All Taxpayers

- Includes all returns in the SOI dataset plus all Colorado income tax returns that were excluded from the SOI dataset

- Returns were excluded from the SOI dataset if they were not full-year residents or they did not match up to an IRS return in the data merging process

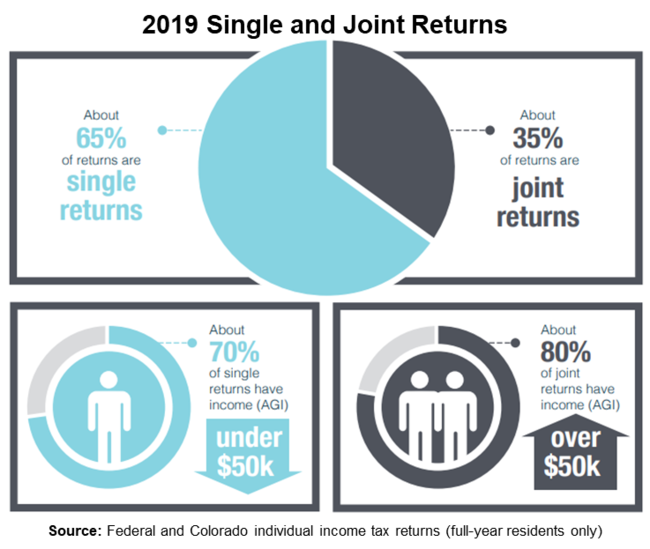

- 2019

-

Enhancements and Changes Since the Previous Report:

- Added Colorado Taxable Income to these tables: 1, 2, 3, 4, 5, 6, 7, 8, 20, 21, 22, 23

- Removed Table 28. Colorado Voluntary Contributions by Size of Federal AGI due to changes in the availability of this data for reporting purposes

Full Report:

- 2019 Individual SOI Report (PDF) includes an introduction, charts, tables, and supplemental information

Data Tables:

- Table 1. Income and Tax Data by Size of Federal AGI

- Table 2. Income and Tax Data by Size of Federal AGI in $10,000 Increments

- Table 3. Income and Tax Data for Single Colorado Returns by Size of Federal AGI

- Table 4. Income and Tax Data for Joint Colorado Returns by Size of Federal AGI

- Table 5. Income and Tax Data for Taxable Returns by Size of Federal AGI

- Table 6. Income and Tax Data for Nontaxable Returns by Size of Federal AGI

- Table 7. Income and Tax Data for Filers Under 65 by Size of Federal AGI

- Table 8. Income and Tax Data for Filers 65 and Older by Size of Federal AGI

- Table 9. Federal AGI by Size of Federal AGI and Filing Status

- Table 10. Colorado Net Tax by Size of Federal AGI and Filing Status

- Table 11. Federal AGI by Size of Federal AGI and Age Group

- Table 12. Colorado Net Tax by Size of Federal AGI and Age Group

- Table 13. Source of Income by Size of Federal AGI

- Table 14. Business Income by Industry

- Table 15. Adjustments to Income by Size of Federal AGI

- Table 16. Income and Tax Data by Size of Federal AGI and Standard/Itemized Deduction Returns

- Table 17. Standard, Itemized, and Qualified Business Income Deductions by Size of Federal AGI

- Table 18. Itemized Deductions by Size of Federal AGI

- Table 19. Selected Federal Tax Credits by Size of Federal AGI

- Table 20. Income and Tax Data by Region

- Table 21. Income and Tax Data for Regions by Size of Federal AGI

- Table 22. Income and Tax Data by County

- Table 23. Income and Tax Data for Major Counties by Size of Federal AGI

- Table 24. Colorado Income and Tax Data by Size of Colorado Taxable Income in $10,000 Increments

- Table 24 Supp. Colorado Income and Tax Data by Size of Colorado Taxable Income in $10,000 Increments (All Taxpayers)

- Includes all returns in the SOI dataset plus all Colorado income tax returns that were excluded from the SOI dataset

- Returns were excluded from the SOI dataset if they were not full-year residents or they did not match up to an IRS return in the data merging process

- Table 25. Colorado Additions and Subtractions by Size of Federal AGI

- Table 26. Colorado Income Tax Prepayments by Size of Federal AGI

- Table 27. Colorado Tax Credits by Size of Federal AGI

Supplemental Information:

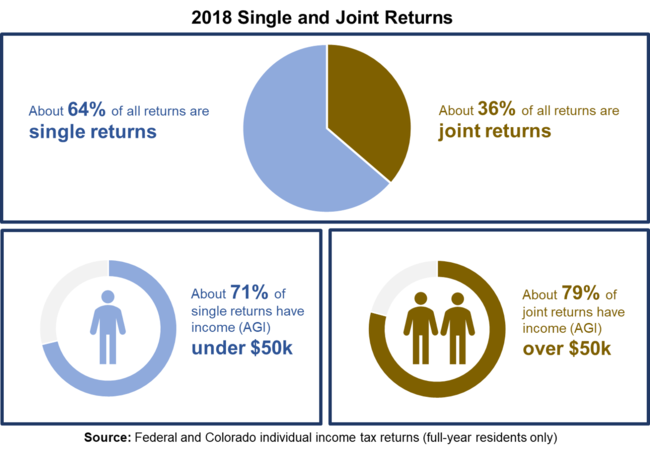

- 2018

-

Enhancements and Changes Since the Previous Report:

- Added three new tables:

- Table 14 - Business Income by Industry

- Table 19 - Selected Federal Tax Credits by Size of Federal AGI

- Table 26 - Colorado Income Tax Prepayments by Size of Federal AGI

- Significant changes made to three tables:

- Table 17 - This table no longer summarizes personal exemptions (see 2017 Table 18), but now includes qualified business income deductions. These modifications were made due to federal tax return changes.

- Table 20 and Table 21 - Five Colorado regions are now summarized instead of the 14 planning regions summarized in previous SOI reports.

- Formatting changes:

- All values are now rounded to the nearest dollar.

- Previous reports rounded summed totals to the nearest thousand, which will affect comparisons to prior year data.

Narrative and Charts:

- 2018 Individual SOI Narrative and Charts (PDF)

- Includes an introduction, highlights, charts, and methodology

- Features insights into major changes that started tax year 2018 due to the federal Tax Cuts and Jobs Act of 2017 (TCJA) (NEW!)

- TCJA Overview and Impacts section includes charts and tables that compare 2018 and 2017 to demonstrate the impacts the TCJA had on Colorado income tax filers (NEW!)

Data Tables:

The 2018 Individual SOI tables summarize key statistics on income and tax data by income group, including the number of returns, federal adjusted gross income (AGI), federal taxable income, Colorado gross tax, Colorado net tax, and federal tax. The aggregate data is split into various groupings, such as filing status, age, and location. Four tables (Tables 7, 8, 11, and 12) break out return data by age group. Information on the composition of Colorado households can be found by examining filing statuses (Tables 3, 4, 9, and 10). Detailed data on sources of income, business income by industry, and adjustments to income are reported in Tables 13, 14, and 15. Reductions from federal income such as standard, itemized, and qualified business income deductions are presented in Tables 16, 17, and 18. Selected federal tax credits are summarized in table 19. Geographic (county or region) data is presented in Tables 20 through 23. Data specific to the calculation of Colorado taxable income and tax due — including additions, subtractions, tax prepayments, tax credits, and voluntary contributions — are the focus of Tables 24 through 28.

- Table 1. Income and Tax Data by Size of Federal AGI

- Table 2. Income and Tax Data by Size of Federal AGI in $10,000 Increments

- Table 3. Income and Tax Data for Single Colorado Returns by Size of Federal AGI

- Table 4. Income and Tax Data for Joint Colorado Returns by Size of Federal AGI

- Table 5. Income and Tax Data for Taxable Returns by Size of Federal AGI

- Table 6. Income and Tax Data for Non-Taxable Returns by Size of Federal AGI

- Table 7. Income and Tax Data for Filers Under 65 by Size of Federal AGI

- Table 8. Income and Tax Data for Filers 65 and Older by Size of Federal AGI

- Table 9. Federal AGI by Size of Federal AGI and Federal Filing Status

- Table 10. Colorado Net Tax by Size of Federal AGI and Federal Filing Status

- Table 11. Federal AGI by Size of Federal AGI and Age Group

- Table 12. Colorado Net Tax by Size of Federal AGI and Age Group

- Table 13. Source of Income by Size of Federal AGI

- Table 14. Business Income by Industry (NEW!)

- Table 15. Adjustments to Income by Size of Federal AGI

- Table 16. Income and Tax Data by Size of Federal AGI and Standard/Itemized Deduction Returns

- Table 17. Standard, Itemized, and Qualified Business Income Deductions by Size of Federal AGI

- Table 18. Itemized Deductions by Size of Federal AGI

- Table 19. Selected Federal Tax Credits by Size of Federal AGI (NEW!)

- Table 20. Income and Tax Data by Region

- Table 21. Income and Tax Data for Regions by Size of Federal AGI

- Table 22. Income and Tax Data by County

- Table 23. Income and Tax Data for Major Counties by Size of Federal AGI

- Table 24. Colorado Income and Tax Data by Size of Colorado Taxable Income in $10,000 Increments

- Table 24 Supplement. Colorado Income and Tax Data by Size of Colorado Taxable Income in $10,000 Increments

- This supplemental table to the Individual SOI summarizes all of the returns that were included in SOI and all Colorado income tax returns that were excluded from the SOI data set– either because the returns were not full-year residents or because they did not match up to an IRS return in the data merging process.

- This information is provided to help the data users apply their own weighting methodologies if needed.

- Table 25. Colorado Additions and Subtractions by Size of Federal AGI

- Table 26. Colorado Income Tax Prepayments by Size of Federal AGI (NEW!)

- Table 27. Colorado Tax Credits by Size of Federal AGI

- Table 28. Colorado Voluntary Contributions by Size of Federal AGI

Supplemental Information:

- Added three new tables:

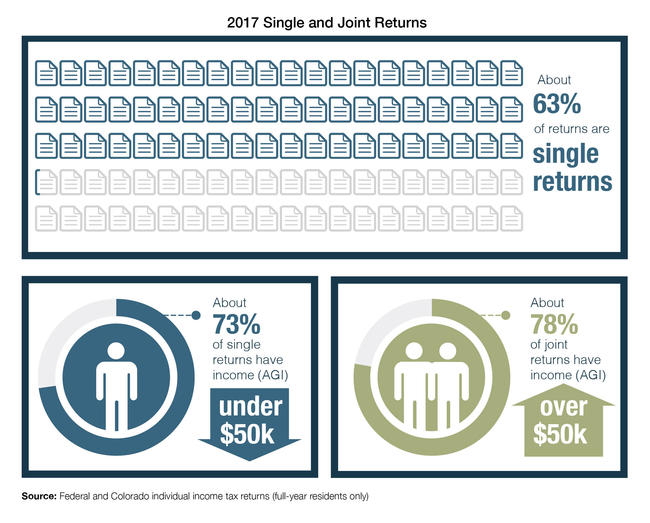

- 2017

-

Enhancements and Changes Since the Previous Report:

- Added narrative with charts in the full report to highlight and elaborate on selected income tax data

Full Report:

- 2017 Individual SOI Report (PDF) includes the narrative (NEW!), charts, tables, and supplemental information

Data Tables:

- Table 1. Income and Tax Data by Size of Federal AGI

- Table 2. Income and Tax Data by Size of Federal AGI in $10,000 Increments

- Table 3. Income and Tax Data for Single Colorado Returns by Size of Federal AGI

- Table 4. Income and Tax Data for Joint Colorado Returns by Size of Federal AGI

- Table 5. Income and Tax Data for Taxable Returns by Size of Federal AGI

- Table 6. Income and Tax Data for Non-Taxable Returns by Size of Federal AGI

- Table 7. Income and Tax Data for Filers Under 65 by Size of Federal AGI

- Table 8. Income and Tax Data for Filers 65 and Older by Size of Federal AGI

- Table 9. Federal AGI by Size of Federal AGI and Federal Filing Status

- Table 10. Colorado Net Tax by Size of Federal AGI and Federal Filing Status

- Table 11. Federal AGI by Size of Federal AGI and Age Group

- Table 12. Colorado Net Tax by Size of Federal AGI and Age Group

- Table 13. Federal AGI by Size of Federal AGI and Number of Personal Exemptions

- Table 14. Colorado Net Tax by Size of Federal AGI and Number of Personal Exemptions

- Table 15. Source of Income by Size of Federal AGI

- Table 16. Adjustments to Income by Size of Federal AGI

- Table 17. Income and Tax Data by Size of Federal AGI and Standard/Itemized Deduction Returns

- Table 18. Exemptions and Standard/Itemized Deductions by Size of Federal AGI

- Table 19. Itemized Deductions by Size of Federal AGI

- Table 20. Income and Tax Data by Planning Region

- Table 21. Income and Tax Data for Planning Regions by Size of Federal AGI

- Table 22. Income and Tax Data by County

- Table 23. Income and Tax Data for Major Counties by Size of Federal AGI

- Table 24. Colorado Income and Tax Data by Size of Colorado Taxable Income in $10,000 Increments

- Table 24 Supplement. Colorado Income and Tax Data by Size of Colorado Taxable Income in $10,000 Increments

- This supplemental table to the Individual SOI summarizes all of the returns that were included in SOI and all Colorado income tax returns that were excluded from the SOI data set– either because the returns were not full-year residents or because they did not match up to an IRS return in the data merging process.

- This information is provided to help the data users apply their own weighting methodologies if needed.

- Table 25. Colorado Additions and Subtractions by Size of Federal AGI

- Table 26. Colorado Tax Credits by Size of Federal AGI

- Table 27. Colorado Voluntary Contributions by Size of Federal AGI

- 2016

New Enhancements Since the Previous Report:

- Added short descriptions to the tables to help make the data more accessible

- Developed five new tables to provide more breakouts of the data by single/joint filing status and age group

- Created charts to illustrate and highlight some of the SOI data

Data Tables:

- Table 1. Income and Tax Data by Size of Federal AGI

- Table 2. Income and Tax Data by Size of Federal AGI in $10,000 Increments

- NEW! Table 3. Income and Tax Data for Single Colorado Returns by Size of Federal AGI

- NEW! Table 4. Income and Tax Data for Joint Colorado Returns by Size of Federal AGI

- Table 5. Income and Tax Data for Taxable Returns by Size of Federal AGI

- Table 6. Income and Tax Data for Non-Taxable Returns by Size of Federal AGI

- NEW! Table 7. Income and Tax Data for Filers Under 65 by Size of Federal AGI

- Table 8. Income and Tax Data for Filers 65 and Older by Size of Federal AGI

- Table 9. Federal AGI by Size of Federal AGI and Federal Filing Status

- Table 10. Colorado Net Tax by Size of Federal AGI and Federal Filing Status

- NEW! Table 11. Federal AGI by Size of Federal AGI and Age Group

- NEW! Table 12. Colorado Net Tax by Size of Federal AGI and Age Group

- Table 13. Federal AGI by Size of Federal AGI and Number of Exemptions

- Table 14. Colorado Net Tax by Size of Federal AGI and Number of Exemptions

- Table 15. Source of Income by Size of Federal AGI

- Table 16. Adjustments to Income by Size of Federal AGI

- Table 17. Income and Tax Data by Size of Federal AGI and Standard/Itemized Deduction Returns

- Table 18. Exemptions and Standard/Itemized Deductions by Size of Federal AGI

- Table 19. Itemized Deductions by Size of Federal AGI

- Table 20. Income and Tax Data by Planning Region

- Table 21. Income and Tax Data for Planning Regions by Size of Federal AGI

- Table 22. Income and Tax Data by County

- Table 23. Income and Tax Data for Major Counties by Size of Federal AGI

- Table 24. Colorado Income and Tax Data by Size of Colorado Taxable Income in $10,000 Increments

- Table 24 Supplement. Colorado Income and Tax Data by Size of Colorado Taxable Income in $10,000 Increments

- This supplemental table to the Individual SOI summarizes all of the returns that were included in SOI and all Colorado income tax returns that were excluded from the SOI data set– either because the returns were not full-year residents or because they did not match up to an IRS return in the data merging process.

- This information is provided to help the data users apply their own weighting methodologies if needed.

- Table 25. Colorado Additions and Subtractions by Size of Federal AGI

- Table 26. Colorado Tax Credits by Size of Federal AGI

- Table 27. Colorado Tax Checkoff Donations by Size of Federal AGI

Charts:

- NEW! Proportions of Colorado Net Tax for Single/Joint Returns by Size of Federal AGI

- NEW! Number of Returns Filed by Age (18-100) and Single/Joint Returns

- NEW! Average Adjusted Gross Income Per Return by Age (18-100) and Single/Joint Returns

- NEW! Number of Returns Filed by Colorado County

- NEW! Average Adjusted Gross Income Per Return by Colorado County

- NEW! Exemptions, Deductions, and Single/Joint Returns -- Multiple Charts

- 2015

New Enhancements Since the Previous Report:

- Updates were made to the 2015 SOI to improve the accuracy of the reporting which may limit comparability of the data to prior years’ publications

- See the PDF report for additional information such as Introductions, 2013-to-2015 Table Crosswalks, Data Glossaries, and Publication Changes

Full Report:

- Full Report (PDF) includes the tables and supplemental information

Data Tables:

- Table 1. Income and Tax Data by Size of Federal AGI

- Table 2. Income and Tax Data by Size of Federal AGI in $10,000 Increments

- Table 3. Income and Tax Data for Taxable Returns by Size of Federal AGI

- Table 4. Income and Tax Data for Non-Taxable Returns by Size of Federal AGI

- Table 5. Income and Tax Data for Residents 65 and Older by Size of Federal AGI

- Table 6. Federal AGI by Size of Federal AGI and Filing Status

- Table 7. Colorado Net Tax by Size of Federal AGI and Filing Status

- Table 8. Federal AGI by Size of Federal AGI and Number of Exemptions

- Table 9. Colorado Net Tax by Size of Federal AGI and Number of Exemptions

- Table 10. Income by Size of Federal AGI and Source of Income

- Table 11. Federal AGI by Size of Federal AGI and Type of Adjustment

- Table 12. Income and Tax Data by Size of Federal AGI and Standard/Itemized Deduction Returns

- Table 13. Exemptions and Standard/Itemized Deductions by Size of Federal AGI

- Table 14. Itemized Deductions by Size of Federal AGI

- Table 15. Income and Tax Data by Planning Region

- Table 16. Income and Tax Data for Planning Regions by Size of Federal AGI

- Table 17. Income and Tax Data by County

- Table 18. Income and Tax Data for Major Counties by Size of Federal AGI (Adams, Arapahoe, Boulder, Denver, Douglas, El Paso, Jefferson, Larimer, Mesa, Pueblo, Weld)

- Table 19. Colorado Income and Tax Data by Size of Colorado Taxable Income in $10,000 Increments

- Table 19 Supplement. Colorado Income and Tax Data by Size of Colorado Taxable Income in $10,000 Increments

- This supplemental table to the Individual SOI summarizes all of the returns that were included in SOI and all Colorado income tax returns that were excluded from the SOI data set– either because the returns were not full-year residents or because they did not match up to an IRS return in the data merging process.

- This information is provided to help the data users apply their own weighting methodologies if needed.

- Table 20. Colorado Additions and Subtractions by Size of Federal AGI

- Table 21. Colorado Tax Credits Claimed by Size of Federal AGI

- Table 22. Colorado Tax Checkoff Donations by Size of Federal AGI

- 2014

The 2014 Individual SOI will not be published due to a technical issue with the IRS data file.

- 2013

Tables:

Full Report (PDF) with Tables 1A through 24

- 2012

Tables:

- Table 1A. Federal AGI and Tax, All Full-year Resident Returns

- Table 1B. Federal AGI, Taxable Full-year Resident Returns

- Table 1C. Federal AGI and Tax, Non-Taxable Full-year Resident Returns

- Table 2. Colorado Returns Classified by Type of Deduction

- Table 3. Colorado Returns Classified by Filing Status

- Table 4. Federal AGI Classified by Filing Status

- Table 5. Colorado Net Tax Classified by Filing Status

- Table 6. Colorado Returns Classified by Number of Exemptions

- Table 7. Federal AGI Classified by Number of Exemptions

- Table 8. Colorado Net Tax Classified by Number of Exemptions

- Table 9. Federal AGI and Taxes, Returns of Residents 65 and Older

- Table 10. Number of Returns by Type of Adjustment to Total Income

- Table 11. Adjustments to Total Income by Type of Deduction

- Table 12. Amount of Deferral Exemptions, Deductions, and Taxable Income

- Table 13. Number of Returns Classified by Source of Taxable Income

- Table 14. Colorado Income by Source of Taxable Income

- Table 15. Number of Returns by Type of Itemized Deduction

- Table 16. Type and Amount of Itemized Deductions

- Table 17. Federal AGI and Tax by Planning Region

- Table 18. Federal AGI and Tax by County

- Table 19. Federal AGI and Tax by Major County

- Table 20. Number of Returns Claiming Colorado Modifications

- Table 21. Amount of Colorado Modifications

- Table 22. Colorado Returns by Liability Status

- Table 23. Amount and Number of Tax Checkoff Donations

- Table 24. Amount and Number of Income Tax Credits Claimed

Have a question or a data request related to this page?