About the Reports

The Colorado Corporate Statistics of Income (SOI) report is a collection of data describing Colorado state income tax returns filed by C Corporations that conduct business in Colorado. The report consists of tables that present income and tax data by Colorado taxable income group, federal taxable income group, or industry. This report is prepared annually starting with the 2020 report (it was previously only published every other year). The 2021 report was published in July 2024.

Reports

- 2021

Highlights and Selected Data Tables

- 2021 Corporate SOI: Highlights and Selected Tables (PDF) includes an introduction, highlights, and selected data tables in a PDF

Data Tables:

The 2021 Corporate SOI tables summarize key statistics on income and tax data by Colorado taxable income group, federal taxable income group, or industry. The variables summarized in Tables 1 through 10 include the number of returns, federal taxable income, Colorado taxable income, Colorado gross tax, and Colorado net tax. Some tables aggregate data from all C corporations (Tables 1, 2, 5, 8, and 13), whereas others break out data by corporations that conduct business only in Colorado (Tables 3, 6, 9, and 11) or by corporations that conduct business within and outside of Colorado (Tables 4, 7, 10, and 12). The data is summarized by Colorado taxable income group in Tables 1 through 4 and 11 through 13, by federal taxable income group in Tables 5 through 7, and by industry in Tables 8 through 10. Colorado additions and subtractions claimed by corporations are summarized in Tables 11 and 12. Colorado income tax credits claimed are summarized in Table 13.

- Table 1. All Corporations: Income and Tax Data by Size of Colorado Taxable Income

- Table 2. All Corporations: Income and Tax Data by Size of Colorado Taxable Income in $10,000 Increments

- Table 3. Corporations that Conduct Business Only in Colorado: Income and Tax Data by Size of Colorado Taxable Income

- Table 4. Corporations that Conduct Business Within and Outside of Colorado: Income and Tax Data by Size of Colorado Taxable Income

- Table 5. All Corporations: Income and Tax Data by Size of Federal Taxable Income

- Table 6. Corporations that Conduct Business Only in Colorado: Income and Tax Data by Size of Federal Taxable Income

- Table 7. Corporations that Conduct Business Within and Outside of Colorado: Income and Tax Data by Size of Federal Taxable Income

- Table 8. All Corporations: Income and Tax Data by Industry

- Table 9. Corporations that Conduct Business Only in Colorado: Income and Tax Data by Industry

- Table 10. Corporations that Conduct Business Within and Outside of Colorado: Income and Tax Data by Industry

- Table 11. Corporations that Conduct Business Only in Colorado: Colorado Additions and Subtractions by Size of Colorado Taxable Income

- Table 12. Corporations that Conduct Business Within and Outside of Colorado: Colorado Additions and Subtractions by Size of Colorado Taxable Income

- Table 13. All Corporations: Colorado Income Tax Credits by Size of Colorado Taxable Income

Supplemental Information:

- 2020

-

Corporate SOI is Now Published Annually!

Narrative:

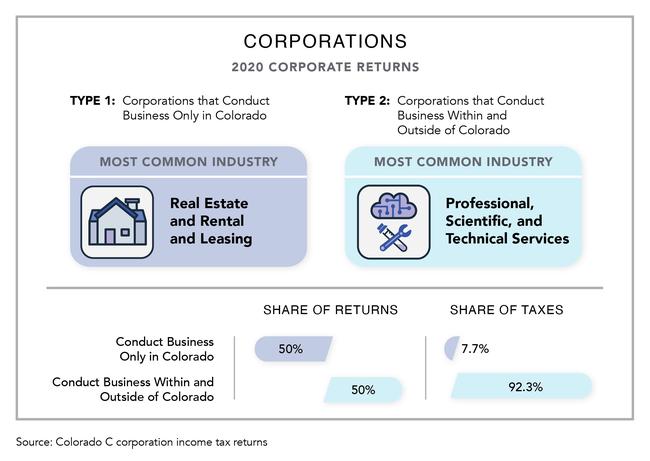

- 2020 Corporate SOI Narrative (PDF) includes introduction, infographic, methodology, and data sources

Data Tables:

The 2020 Corporate SOI tables summarize key statistics on income and tax data by Colorado taxable income group, federal taxable income group, or industry. The variables summarized in Tables 1 through 10 include the number of returns, federal taxable income, Colorado taxable income, Colorado gross tax, and Colorado net tax. Some tables aggregate data from all C corporations (Tables 1, 2, 5, 8, and 13), whereas others break out data by corporations that conduct business only in Colorado (Tables 3, 6, 9, and 11) or by corporations that conduct business within and outside of Colorado (Tables 4, 7, 10, and 12). The data is summarized by Colorado taxable income group in Tables 1 through 4 and 11through 13, by federal taxable income group in Tables 5 through 7, and by industry in Tables 8 through 10. Colorado additions and subtractions claimed by corporations are summarized in Tables 11 and 12. Colorado income tax credits claimed are summarized in Table 13.

- Table 1. All Corporations: Income and Tax Data by Size of Colorado Taxable Income

- Table 2. All Corporations: Income and Tax Data by Size of Colorado Taxable Income in $10,000 Increments

- Table 3. Corporations that Conduct Business Only in Colorado: Income and Tax Data by Size of Colorado Taxable Income

- Table 4. Corporations that Conduct Business Within and Outside of Colorado: Income and Tax Data by Size of Colorado Taxable Income

- Table 5. All Corporations: Income and Tax Data by Size of Federal Taxable Income

- Table 6. Corporations that Conduct Business Only in Colorado: Income and Tax Data by Size of Federal Taxable Income

- Table 7. Corporations that Conduct Business Within and Outside of Colorado: Income and Tax Data by Size of Federal Taxable Income

- Table 8. All Corporations: Income and Tax Data by Industry

- Table 9. Corporations that Conduct Business Only in Colorado: Income and Tax Data by Industry

- Table 10. Corporations that Conduct Business Within and Outside of Colorado: Income and Tax Data by Industry

- Table 11. Corporations that Conduct Business Only in Colorado: Colorado Additions and Subtractions by Size of Colorado Taxable Income

- Table 12. Corporations that Conduct Business Within and Outside of Colorado: Colorado Additions and Subtractions by Size of Colorado Taxable Income

- Table 13. All Corporations: Colorado Income Tax Credits by Size of Colorado Taxable Income

Supplemental Information:

- 2020 Corporate SOI Narrative (PDF) includes introduction, infographic, methodology, and data sources

- Data Sources (Excel)

- 2019

-

Enhancements and Changes Since the Previous Report:

- Developed new tables that show Corporate income tax data by federal taxable income

Full Report:

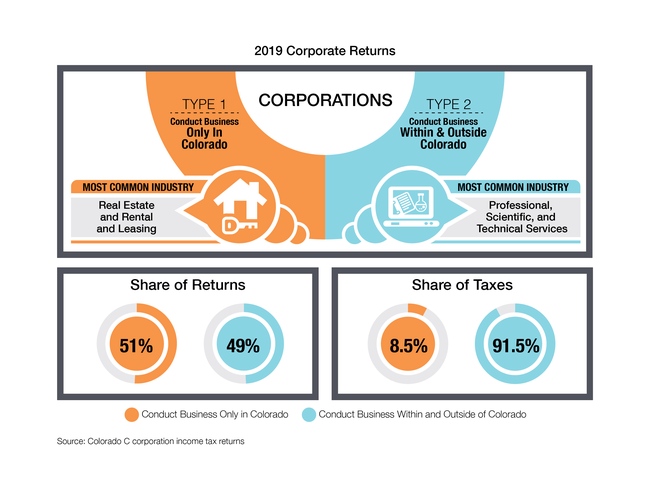

- 2019 Corporate SOI Report (PDF) includes the narrative, infographics, tables, and supplemental information

Data Tables:

- Table 1. All Corporations: Income and Tax Data by Size of Colorado Taxable Income

- Table 2. All Corporations: Income and Tax Data by Size of Colorado Taxable Income in $10,000 Increments

- Table 3. Corporations that Conduct Business Only in Colorado: Income and Tax Data by Size of Colorado Taxable Income

- Table 4. Corporations that Conduct Business Within and Outside of Colorado: Income and Tax Data by Size of Colorado Taxable Income

- NEW! Table 5. All Corporations: Income and Tax Data by Size of Federal Taxable Income

- NEW! Table 6. Corporations that Conduct Business Only in Colorado: Income and Tax Data by Size of Federal Taxable Income

- NEW! Table 7. Corporations that Conduct Business Within and Outside of Colorado: Income and Tax Data by Size of Federal Taxable Income

- Table 8. All Corporations: Income and Tax Data by Industry

- Table 9. Corporations that Conduct Business Only in Colorado: Income and Tax Data by Industry

- Table 10. Corporations that Conduct Business Within and Outside of Colorado: Income and Tax Data by Industry

- Table 11. Corporations that Conduct Business Only in Colorado: Colorado Additions and Subtractions by Size of Colorado Taxable Income

- Table 12. Corporations that Conduct Business Within and Outside of Colorado: Colorado Additions and Subtractions by Size of Colorado Taxable Income

- Table 13. All Corporations: Colorado Income Tax Credits by Size of Colorado Taxable Income

- 2017

-

Enhancements and Changes Since the Previous Report:

- Added short descriptions to the tables to help make the data more accessible

- Developed new tables that show Corporate income tax data by industry

- Split the Colorado Additions and Subtractions by Size of Colorado Taxable Income table into two separate tables based on where the corporations conduct business

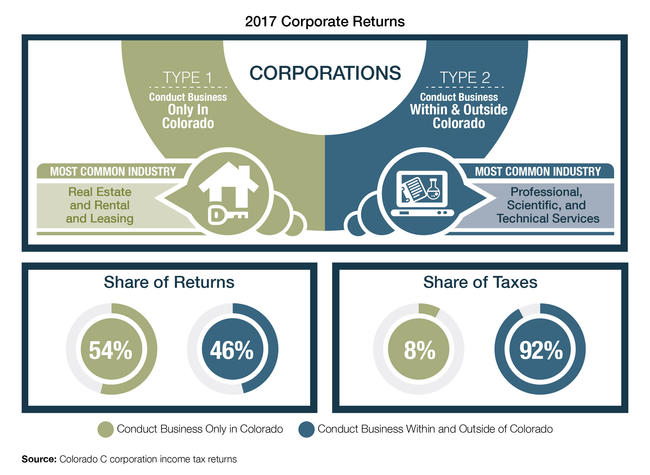

- Added narrative and infographics in the full report to highlight and elaborate on selected income tax data

Full Report:

- 2017 Corporate SOI Report (PDF) includes the narrative (NEW!), infographics (NEW!), tables, and supplemental information

Data Tables:

- Table 1. All Corporations: Income and Tax Data by Size of Colorado Taxable Income

- Table 2. All Corporations: Income and Tax Data by Size of Colorado Taxable Income in $10,000 Increments

- Table 3. Corporations that Conduct Business Only in Colorado: Income and Tax Data by Size of Colorado Taxable Income

- Table 4. Corporations that Conduct Business Within and Outside of Colorado: Income and Tax Data by Size of Colorado Taxable Income

- NEW! Table 5. All Corporations: Income and Tax Data by Industry

- NEW! Table 6. Corporations that Conduct Business Only in Colorado: Income and Tax Data by Industry

- NEW! Table 7. Corporations that Conduct Business Within and Outside of Colorado: Income and Tax Data by Industry

- NEW! Table 8. Corporations that Conduct Business Only in Colorado: Colorado Additions and Subtractions by Size of Colorado Taxable Income

- NEW! Table 9. Corporations that Conduct Business Within and Outside of Colorado: Colorado Additions and Subtractions by Size of Colorado Taxable Income

- Table 10. All Corporations: Colorado Income Tax Credits by Size of Colorado Taxable Income

- 2015

Enhancements and Changes Since the Previous Report:

- Updates were made to the 2015 SOI to improve the accuracy of the reporting which may limit comparability of the data to prior years’ publications

- See the PDF Report for all tables and additional information such as Introductions, 2013-to-2015 Table Crosswalks, Data Glossaries, and Publication Changes

Full Report:

- 2015 Corporate SOI Report (PDF) includes the tables and supplemental information

Data Tables:

- Table 1. Income and Tax Data by Size of Colorado Taxable Income

- Table 2. Income and Tax Data by Size of Colorado Taxable Income in $10,000 Increments

- Table 3. Income and Tax Data for Intrastate Returns by Size of Colorado Taxable Income

- Table 4. Income and Tax Data for Interstate Returns by Size of Colorado Taxable Income

- Table 5. Colorado Income Tax Deductions by Size of Colorado Taxable Income

- Table 6. Colorado Income Tax Credits by Colorado Taxable Income

- 2013

Full Report:

- The 2016 Colorado Tax Profile & Expenditure Report contains the Full Report (PDF) on 2013 Colorado Corporate Statistics of Income on pages 118 through 125.

Have a question or a data request related to this page?