Sales Reports

About the Reports

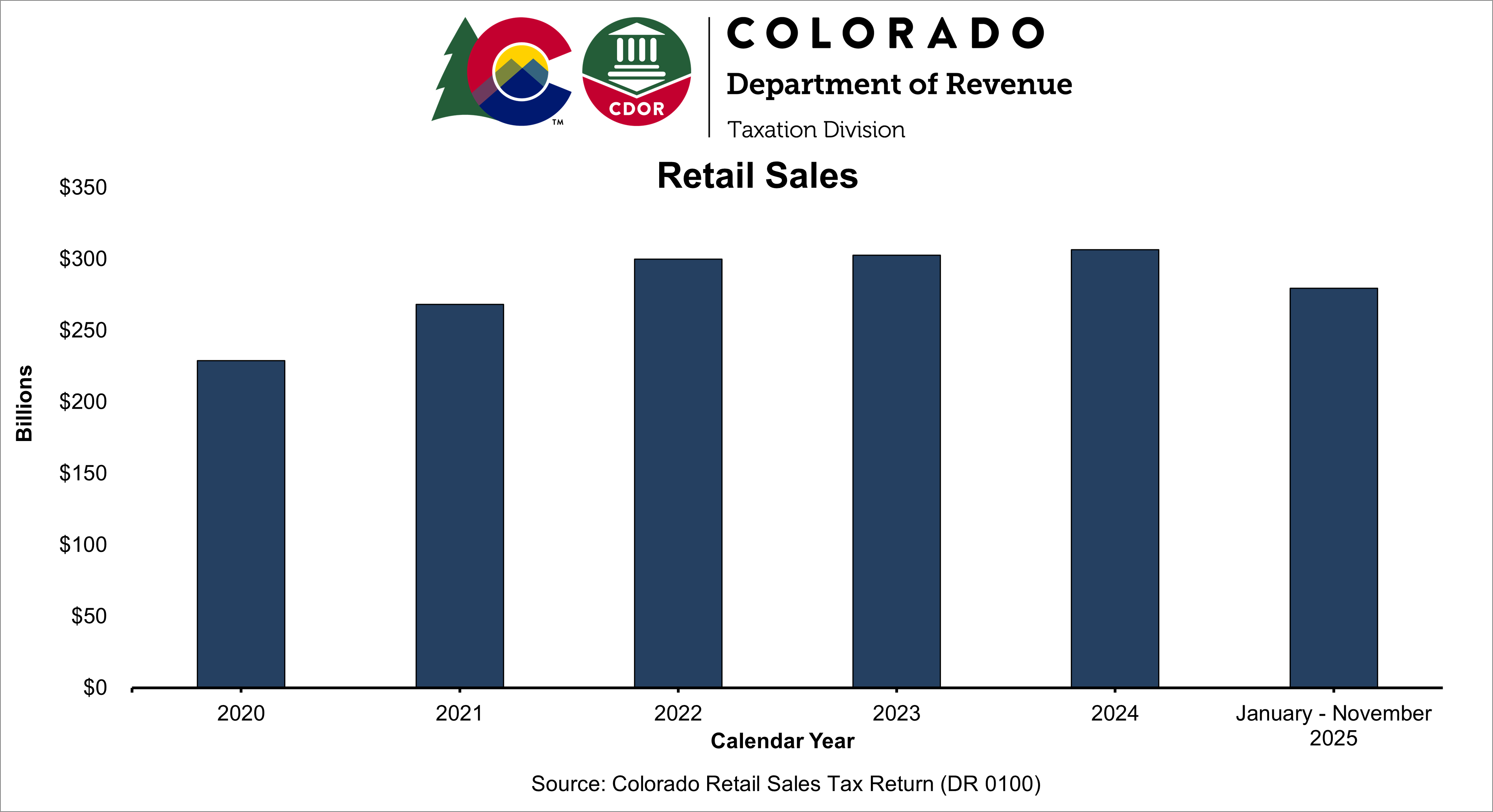

The Sales Reports summarize data from Colorado State Sales Tax Returns (Form DR 0100), broken down by industry, county, and city. In these reports you'll find information on the number of retailers, number of returns, gross sales, retail sales, and state net taxable sales. Additionally, we offer reports on the retail sales in major counties and major cities in Colorado by industry.

Reports

Further Information

Return Filing Frequency - Many businesses file returns monthly, but some file quarterly or annually. This means that months at the end of the quarter (March, June, September, and December) will include data from three months for some businesses, and December (year end) will include data from 12 months for some businesses.

Industry Definitions - The Department uses the North American Industry Classification System (NAICS), the standard used by Federal statistical agencies. Industry categories are reported to the Department by the taxpayer, and they are not generally audited. The NAICS definitions are updated every five years (2012, 2017, 2022, etc.).

City Definitions - Prior to 2021, the City reports included some unincorporated areas. Starting in 2021, the City reports only include incorporated municipalities. This happened because the Department reduced location codes as part of sales tax simplification and HB19-1240 as well as the hold harmless statute (§39-26-105.2).

Destination Sourcing - Beginning in June 2019, most in-state retailers and all out of state retailers were required to file returns and collect and remit taxes based on the location in which the purchaser received the goods. Small retailers were allowed to continue to file returns and collect and remit taxes based on the retailer’s business location through September 2022.

Have a question or a data request related to this page?