Firearms and Ammunition Tax Report

About the Report

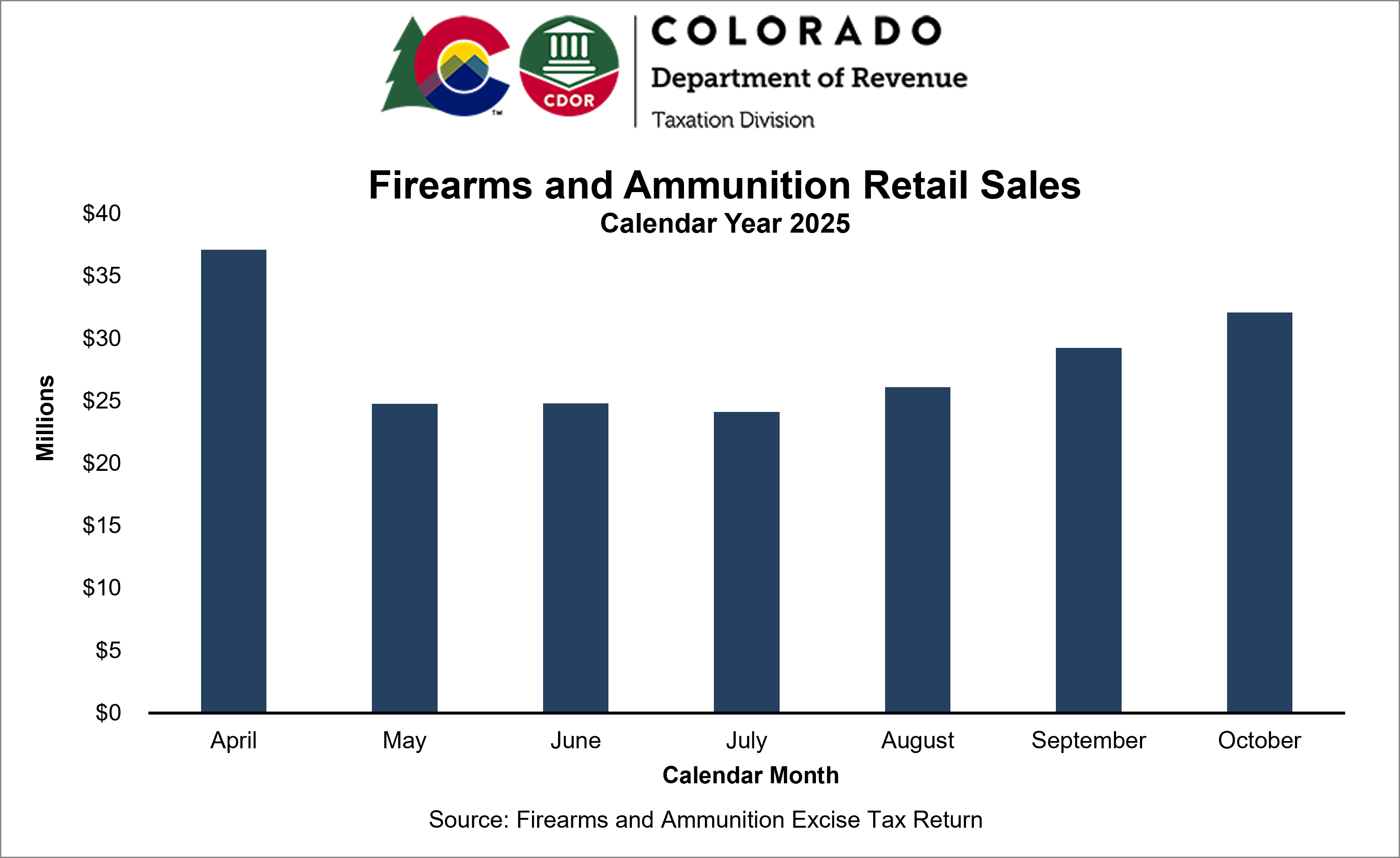

The Firearms and Ammunition Tax Report summarizes the number of retailers, retail sales, net taxable sales, and excise tax as reported on the Firearms and Ammunition Excise Tax Return. Firearms and Ammunition Excise Tax Returns are filed monthly by retail vendors of firearms, firearm precursor parts, and ammunition doing business in Colorado, including manufacturers who make retail sales. The 6.5% excise tax went into effect April 1st, 2025 after Proposition KK was approved by voters in November 2024. New data is added to the report on a monthly basis.

Have a question or a data request related to this page?